Tax Return Eitc 2025

Tax Return Eitc 2025. Claim the eitc for prior years. Their taxable income on form 1040, line 15, is $25,300.

This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. But can it also increase irs audit risk?

This earned income tax credit tool is for tax year 2025 and is being updated as information becomes available.

T150154 Extend ATRA Earned Tax Credit (EITC) Provisions, by, See the earned income and adjusted gross income (agi) limits, maximum credit for the current year, previous years and the upcoming tax year. The earned income tax credit ( eitc) is a tax credit that may give you money back at tax time or lower the federal taxes you owe.

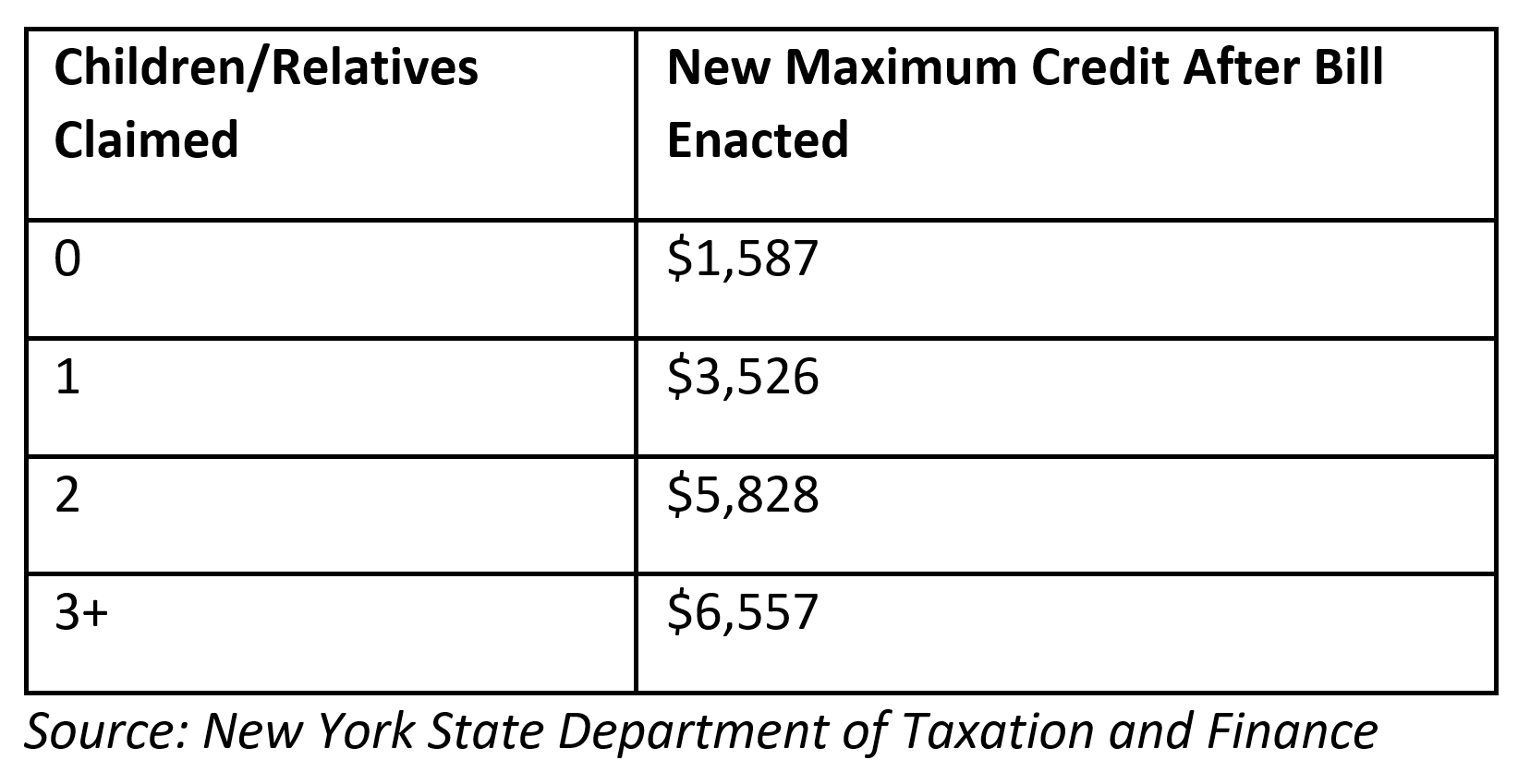

T160036 Senator Cruz's Tax Reform Plan with EITC Enhancement, by, The earned income tax credit (eitc) is a valuable tax benefit for 2025 tax season designed to alleviate financial burden from the working individuals and families. If you were eligible, you can still claim the eitc for prior years:

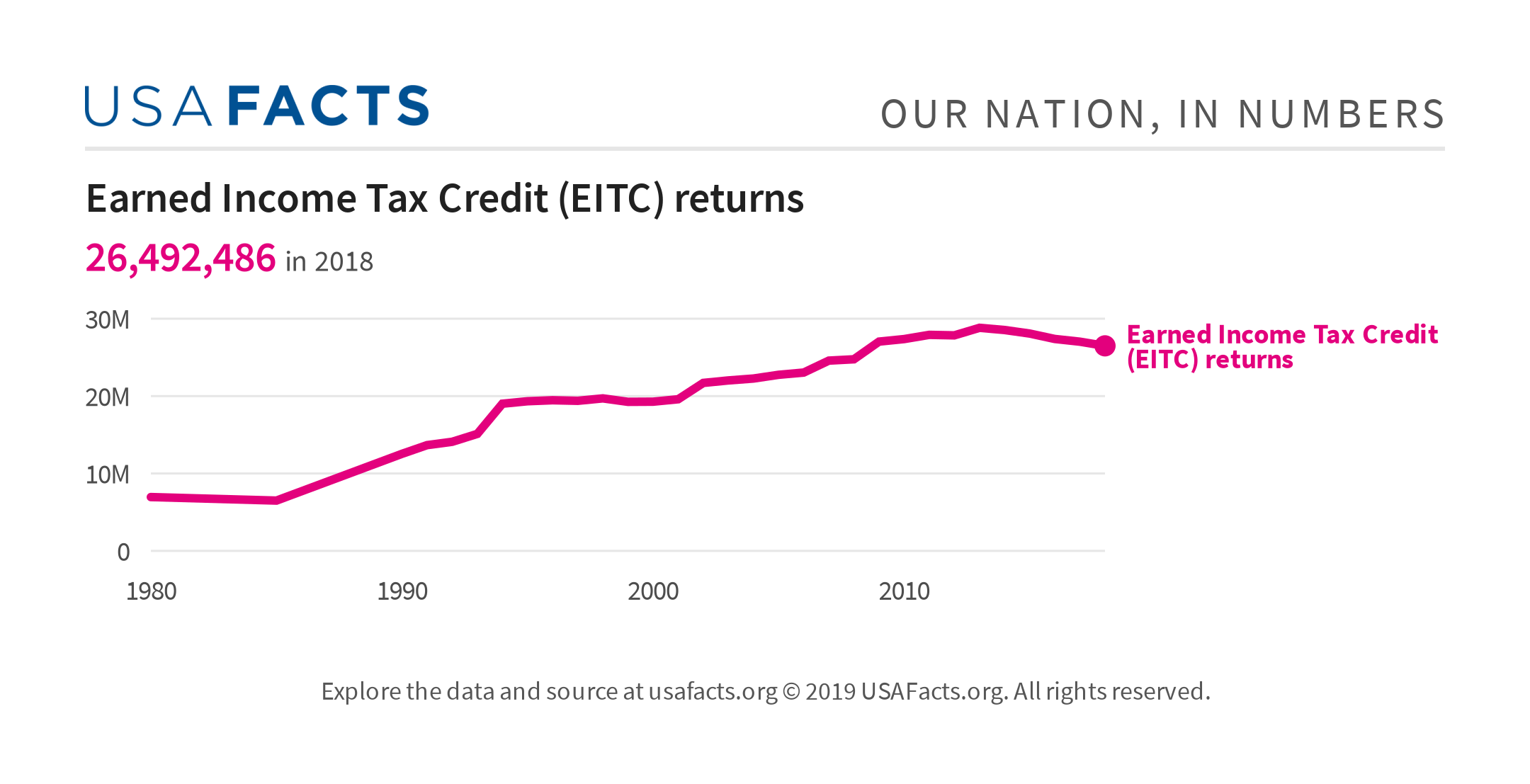

Earned Tax Credit (EITC) returns USAFacts, Remember, congress passed a law that requires the irs to hold all tax refunds that include the earned income tax credit (eitc) and additional child tax credit (actc). It’s a tax credit that ranges from $560 to $6,935 for the 2025.

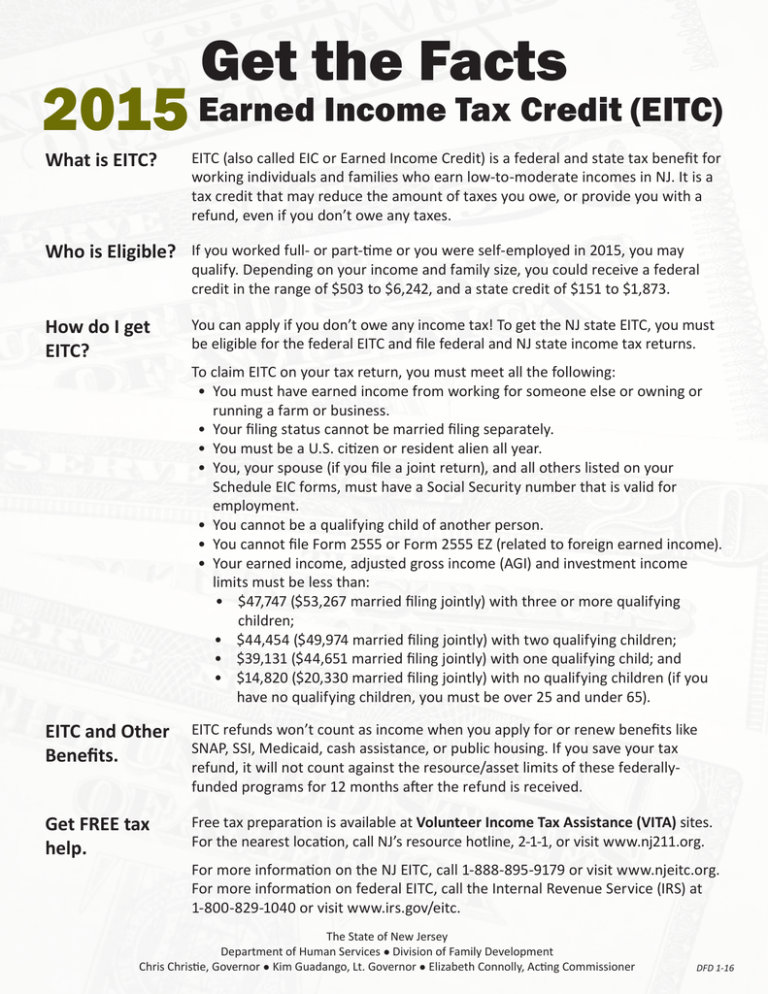

Earned Tax Credit Pdf, Claim the eitc for prior years. Their taxable income on form 1040, line 15, is $25,300.

What is EITC?, Free online income tax calculator to estimate u.s federal tax refund or owed amount for both salary earners and independent contractors. For tax year 2025 — the taxes you'll likely file in spring 2025 — the maximum eitc amount will rise to $632 for taxpayers without a qualifying kid, $4,213.

Federal Returns with EITC Tax Policy Center, See the earned income and adjusted gross income (agi) limits, maximum credit for the current year, previous years and the upcoming tax year. Earned income tax credit in 2025.

NY Lawmakers Urge Inclusion of Expanded Earned Tax Credit in, Claim the eitc for prior years. Remember, congress passed a law that requires the irs to hold all tax refunds that include the earned income tax credit (eitc) and additional child tax credit (actc).

state EITC as percentage of federal credit Tax Policy Center, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. Earned income tax credit in 2025.

All About the Earned Tax Credit AccountAbilities LLC, It’s a tax credit that ranges from $560 to $6,935 for the 2025. If you earned less than $63,398 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2025, you may.

2025 Eic Chart Natka Vitoria, For 2025 if you file your tax return by april 18, 2026. As soon as new 2025 relevant tax year data has been.

To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit.

The earned income tax credit ( eitc) is a tax credit that may give you money back at tax time or lower the federal taxes you owe.